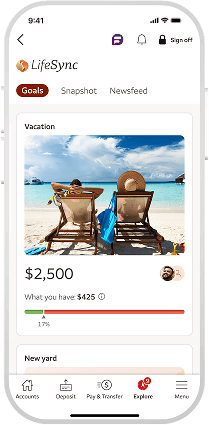

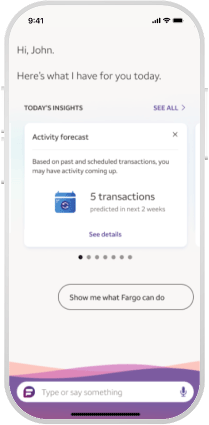

Save more

starting today

Bank your way with confidence

Frequently Asked Questions

A savings account is a bank account where you can store your money and earn interest. Wells Fargo offers interest-bearing savings accounts.

Wells Fargo savings accounts allow you to save automatically to help you build towards your savings goals. In return for keeping your money in a savings account, we pay you interest depending on your interest rate.

Check today's rates.

Yes, all Wells Fargo savings funds in both savings accounts and Certificate of Deposit (CD) accounts are FDIC-insured up to the maximum applicable limit.

Visit our FDIC Insurance page to learn more.

You can open a savings account online or in-person at a Wells Fargo branch. You must be 18 or older to apply online. 17 and under must open at a branch.

To open this account online, you'll need to:

- Be 18 years or older

- Know your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

- Have a physical U.S. address

- Have your own mobile phone number

IDs required to open (plus co-applicant’s information if applicable).

Joint Way2Save Savings and Platinum Savings accounts can be opened online or in-person at a Wells Fargo branch.

To open in-person make an appointment.

You need the same information that is required to open an individual savings account, but you’ll need it for both applicants.

IDs required to open.

Anyone can open a joint savings account as long as they meet all eligibility requirements. This includes family members, spouses, roommates, and unmarried individuals.

Yes, you can enroll in Overdraft Protection. Use your Way2Save Savings account to help protect your linked Wells Fargo checking account from overdrafts.

PM-04072027-7209006.1.4